Bill Cubin CPA, CGMA, Tax Manager

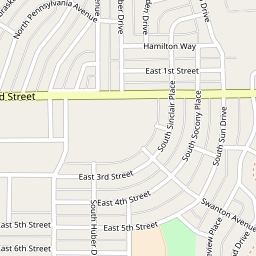

82609 Casper, United States

Bill Cubin CPA, CGMA, Tax Manager Company Information

General information

The Social Security Administration will begin mailing "Educational Correspondence" notices to businesses and employers whose W2 Forms contain name and Social Security Number (SSN) combinations that do not match their records. If you receive one of these notices, please contact our office for assistance. In the meantime, make sure you are following the guidelines below: EMPLOYER REQUIREMENTS FOR NEW HIRES: All employees must complete a W4 Form (Employee's Withholding Allowance Certificate) and I9 Form (Employment Eligibility Verification). W4: New employees must submit a signed W4 when they begin employment in order for the employer to know the correct amount of income tax to withhold from employees' wages. The W4 should have the employee's full name, mailing address and correct SSN so an accurate W2 can be prepared for them. As an Employer, you are required to retain W4 records for at least 4 years after the due date of the employee's personal income tax return (April 15) for the year in which the wages were paid. I9: New employees must complete an Employment Eligibility I9 Form. The employer must verify the employment eligibility and identity documents presented by the employee and record the information on the I9 within three days of employment. If an employer fails to complete and maintain an I9 for each new hire, they may be subject to fines or other legal ramifications from the Department of Labor. Employees must present original documents and not photocopies to employers. Employers must keep copies of I9s for three years after an employee's start date or one year after employment is terminated, whichever is later. Make sure both Forms are complete and legible with all required information. These Forms are available at our office or can easily be found online. See the attached letter from the Social Security Administration describing the matching program and go to www.social security.gov/employer for more information.

Country Club Road 300 Casper

- Opening hours

-

Monday:08:00 - 17:30Tuesday:08:00 - 17:30Wednesday:08:00 - 17:30Thursday:08:00 - 17:30Friday:08:00 - 17:30

- Phone number

- +1307-577-4040

- Linki

- Social Accounts

-

- Keywords

- tax consultant

Bill Cubin CPA, CGMA, Tax Manager Reviews & Ratings

How do you rate this company?

Are you the owner of this company? If so, do not lose the opportunity to update your company's profile, add products, offers and higher position in search engines.